Page 11 - Defining New Ways - CHC Annual Report 2018

P. 11

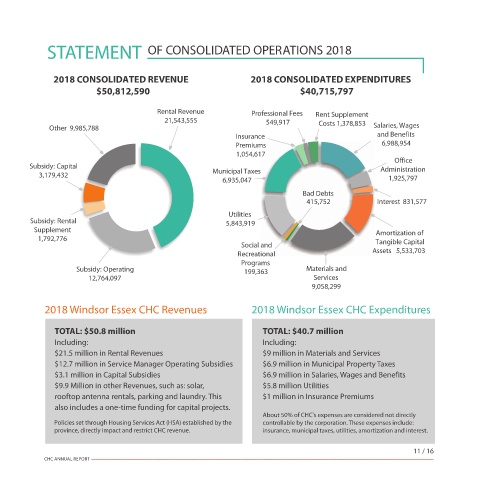

STATEMENT OF CONSOLIDATED OPERATIONS 2018

2018 CONSOLIDATED REVENUE 2018 CONSOLIDATED EXPENDITURES

$50,812,590 $40,715,797

Rental Revenue Professional Fees Rent Supplement

21,543,555 549,917 Costs 1,378,853

Other 9,985,788 Salaries, Wages

Insurance and Benefits

Premiums 6,988,954

1,054,617

Office

Subsidy: Capital Administration

3,179,432 Municipal Taxes

6,935,047 1,925,797

Bad Debts

415,752 Interest 831,577

Utilities

Subsidy: Rental 5,843,919

Supplement Amortization of

1,792,776 Tangible Capital

Social and

Recreational Assets 5,533,703

Programs

Subsidy: Operating 199,363 Materials and

12,764,097 Services

9,058,299

2018 Windsor Essex CHC Revenues 2018 Windsor Essex CHC Expenditures

TOTAL: $50.8 million TOTAL: $40.7 million

Including: Including:

$21.5 million in Rental Revenues $9 million in Materials and Services

$12.7 million in Service Manager Operating Subsidies $6.9 million in Municipal Property Taxes

$3.1 million in Capital Subsidies $6.9 million in Salaries, Wages and Benefits

$9.9 Million in other Revenues, such as: solar, $5.8 million Utilities

rooftop antenna rentals, parking and laundry. This $1 million in Insurance Premiums

also includes a one-time funding for capital projects.

About 50% of CHC's expenses are considered not directly

Policies set through Housing Services Act (HSA) established by the controllable by the corporation. These expenses include:

province, directly impact and restrict CHC revenue. insurance, municipal taxes, utilities, amortization and interest.

11 / 16

CHC ANNUAL REPORT